Step-by-Step Configuration

Detailed field mapping and technical explanations

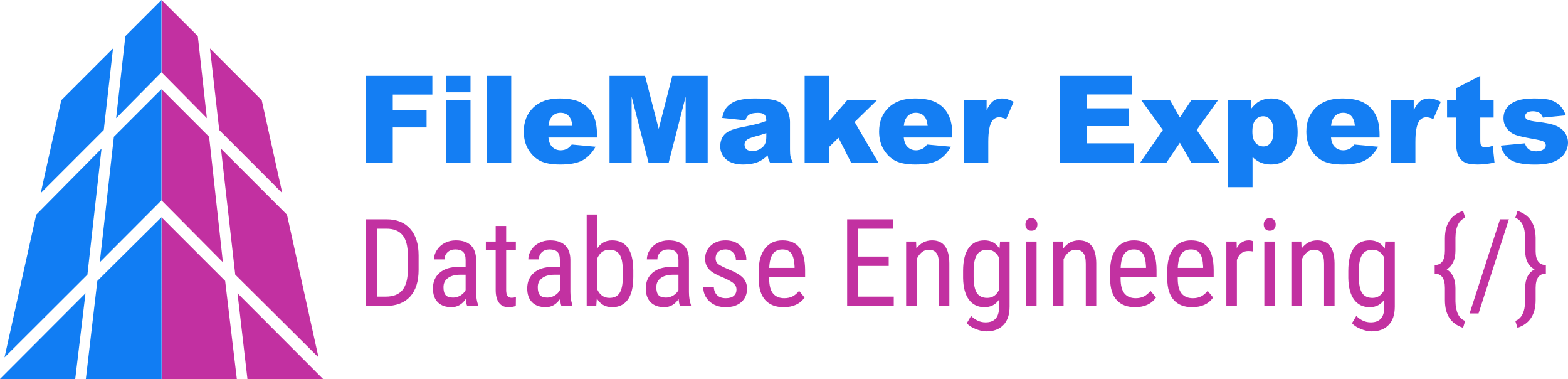

1. Info Tab - ZUGFeRD URL Configuration

ConfigurationEndpoints for ZUGFeRD Data Transfer

The settings define the endpoints for ZUGFeRD data transfer:

📝 Writing Files (Creating a ZUGFeRD/UBL File):

- URL:

https://maps.maro-test.de/mc/zugferd_import_post_data.php - URL PDF Download:

https://maps.maro-test.de/mc/uploads/ - URL XML:

https://maps.maro-test.de/mc/mc_create_ubl_xm.php - URL XML Download:

https://maps.maro-test.de/mc/uploads/

📥 Reading Files (Reading a ZUGFeRD/UBL File):

- URL:

https://maps.maro-test.de/mc/receive_pdf_upload.php - URL PDF Download:

https://maps.maro-test.de/mc/uploads/ - URL XML:

https://maps.maro-test.de/mc/receive_xml_upload.php - URL XML Download:

https://maps.maro-test.de/mc/uploads/

The configuration enables seamless integration between FileMaker and external ZUGFeRD processing services via HTTP interfaces.

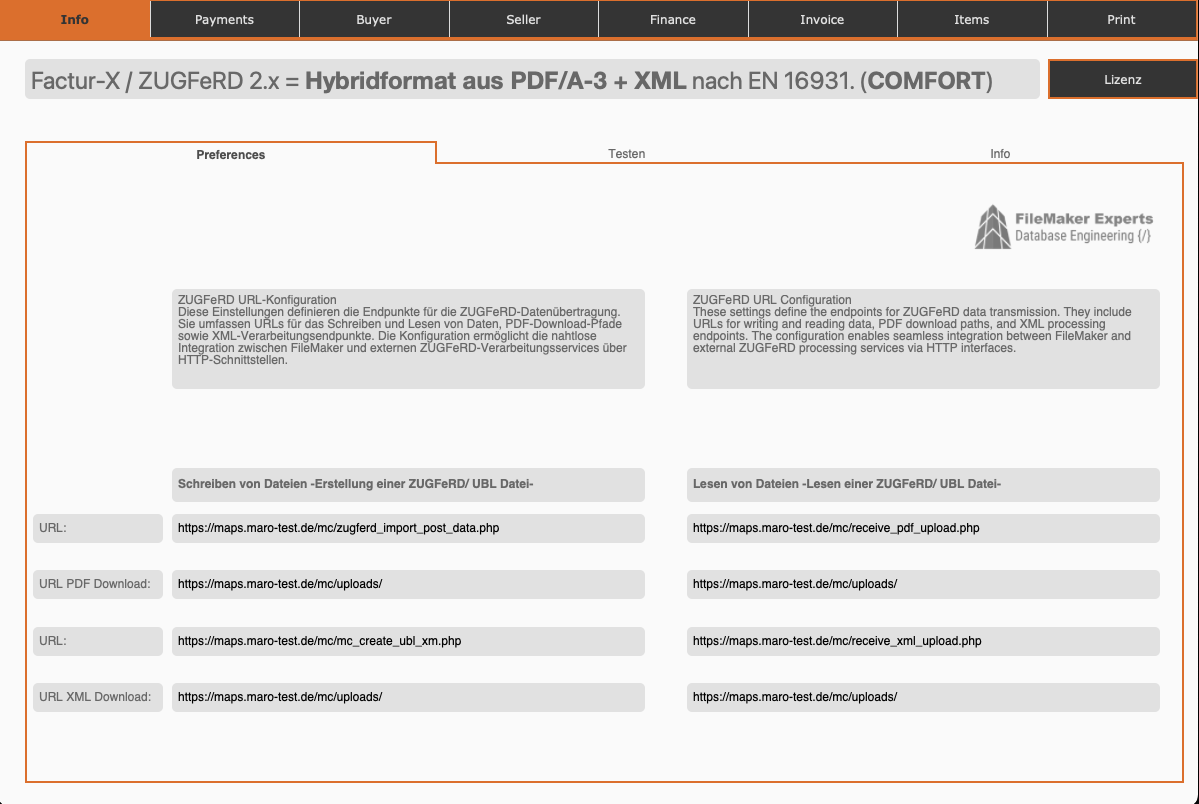

2. Payments Tab - Invoice Mapping

Field MappingMapping FileMaker Fields to ZUGFeRD Fields for Invoices

Select Work Layout: Dropdown selection of the desired layout (e.g. x_invoice_demo). The selected table forms the basis for field mapping.

| ZUGFeRD Field | Description | FileMaker Field |

|---|---|---|

| invoiceNumber | Invoice Number | InvoiceNumber |

| invoiceDate | Invoice Date | InvoiceIssueDate |

| invoiceCurrencyCode | Currency Code (e.g. EUR) | InvoiceCurrencyCode |

| invoiceTypeCode | Invoice Type (380=Invoice, 381=Credit Note) | InvoiceTypeCode |

| dueDate | Payment Due Date | InvoiceDueDate |

| paymentTerms | Payment Terms | InvoicePaymentTerms |

| deliveryTerms | Delivery Terms (Placeholder) | InvoiceNote |

| kunden_nr | Customer Number (not mandatory for ZUGFeRD) | InvoiceBuyerReference |

| lieferschein_nr | Delivery Note Number (optional) | (left empty) |

Important: Fields can come from any table as long as they are correctly assigned. The labels define which field contents will later be transferred to the ZUGFeRD invoice.

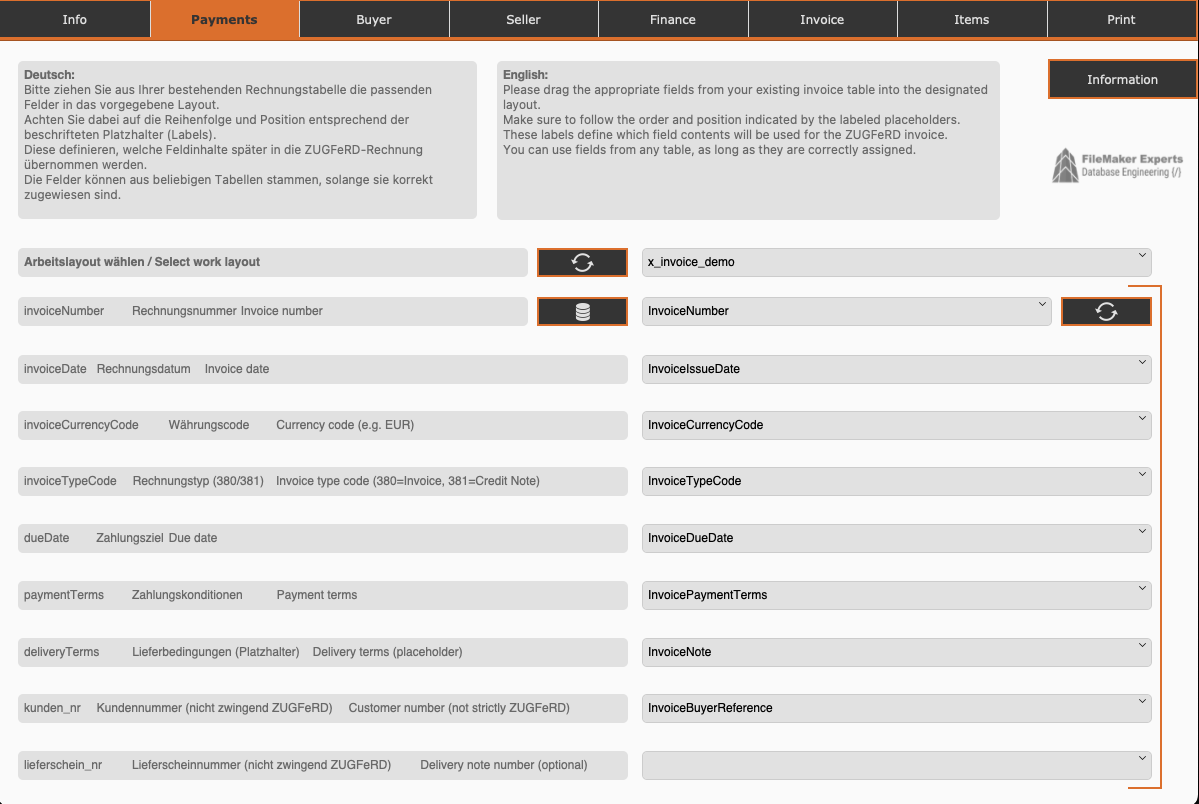

3. Buyer Tab - Buyer Information

Buyer DataMapping Buyer/Customer Data

Select Work Layout: Dropdown: x_buyer_demo

| ZUGFeRD Field | Description | FileMaker Field |

|---|---|---|

| buyerName | Buyer Name / Company | BuyerName |

| buyerStreet | Buyer Street | BuyerStreet |

| buyerPostalCode | Buyer Postal Code | BuyerPostcode |

| buyerCity | Buyer City | BuyerCity |

| buyerCountryCode | Buyer Country (ISO-2) | BuyerCountryCode |

| buyerTaxID | Buyer VAT ID | BuyerVATID |

| buyerID | Customer Number | InvoiceBuyerReference |

Note: Pay attention to the order and position according to the labeled placeholders. These labels define which field contents will later be used for the ZUGFeRD invoice.

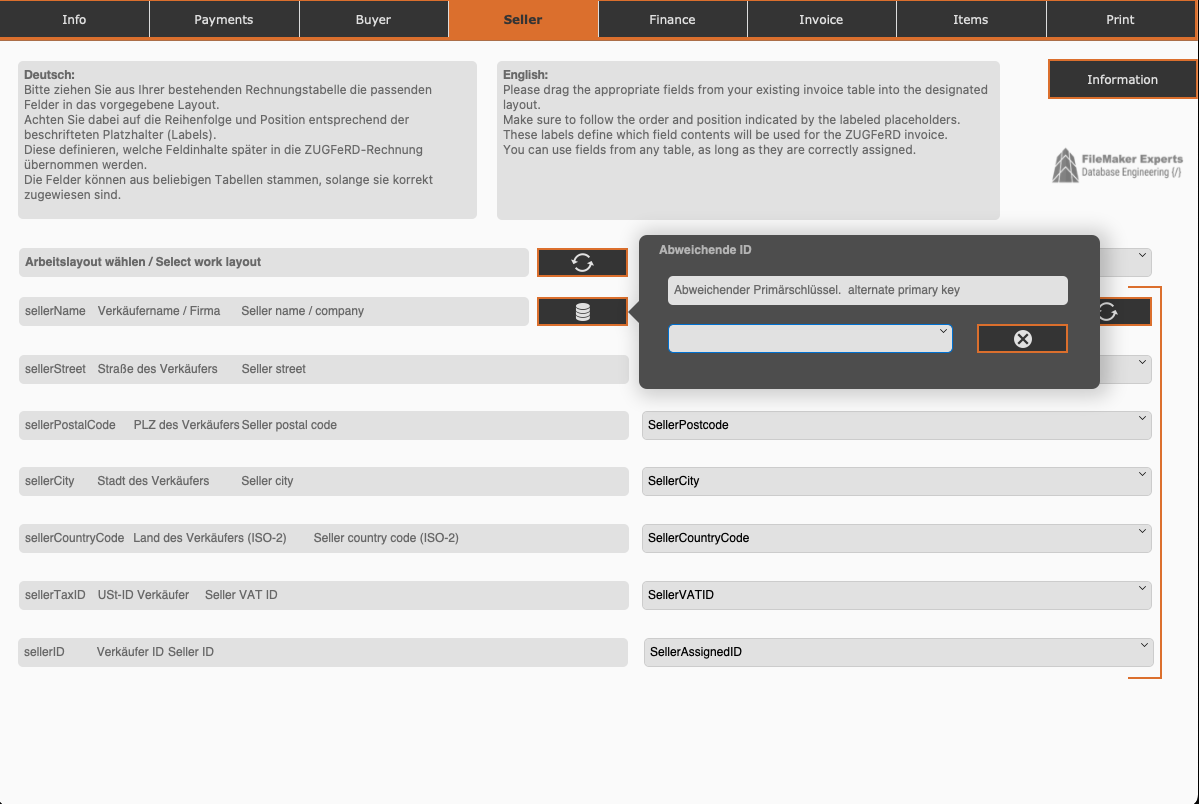

4. Seller Tab - Seller Information

Seller DataMapping Seller/Company Data

Select Work Layout: Selection field with refresh button. In this case, the layout is empty as an alternative ID may be used.

Dialog: Alternative ID

If an alternative identification field should be used:

- Alternative Primary Key: Alternative primary key for data mapping

- Dropdown to select the alternative key field

| ZUGFeRD Field | Description | FileMaker Field |

|---|---|---|

| sellerName | Seller Name / Company | (will be assigned) |

| sellerStreet | Seller Street | SellerStreet |

| sellerPostalCode | Seller Postal Code | SellerPostcode |

| sellerCity | Seller City | SellerCity |

| sellerCountryCode | Seller Country (ISO-2) | SellerCountryCode |

| sellerTaxID | Seller VAT ID | SellerVATID |

| sellerID | Seller ID | SellerAssignedID |

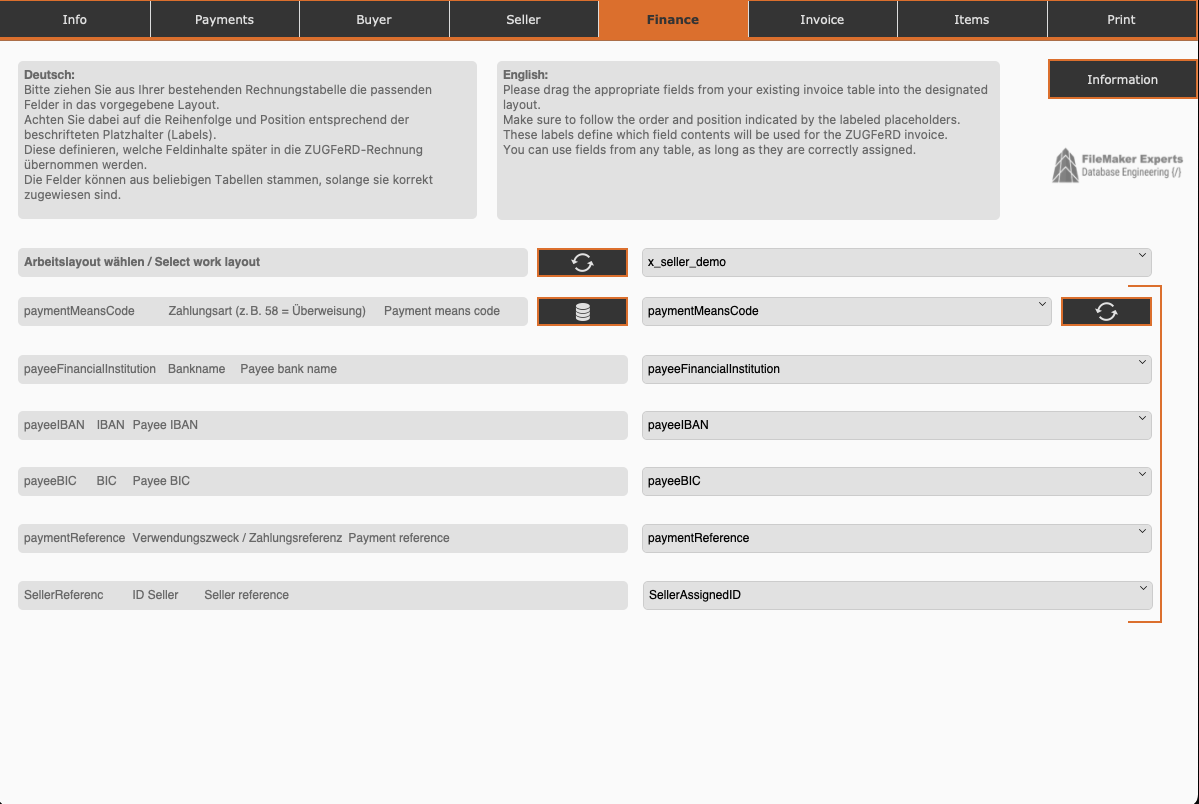

5. Finance Tab - Financial Information

Payment DataMapping Payment and Banking Information

Select Work Layout: Dropdown: x_seller_demo

| ZUGFeRD Field | Description | FileMaker Field |

|---|---|---|

| paymentMeansCode | Payment Method (e.g. 58 = Transfer) | paymentMeansCode |

| payeeFinancialInstitution | Bank Name | payeeFinancialInstitution |

| payeeIBAN | IBAN | payeeIBAN |

| payeeBIC | BIC | payeeBIC |

| paymentReference | Payment Reference / Purpose | paymentReference |

| SellerReferenc | Seller ID | SellerAssignedID |

Payment Method Codes according to ISO 20022:

- 58 = SEPA Credit Transfer

- 48 = Credit Card

- 49 = Direct Debit

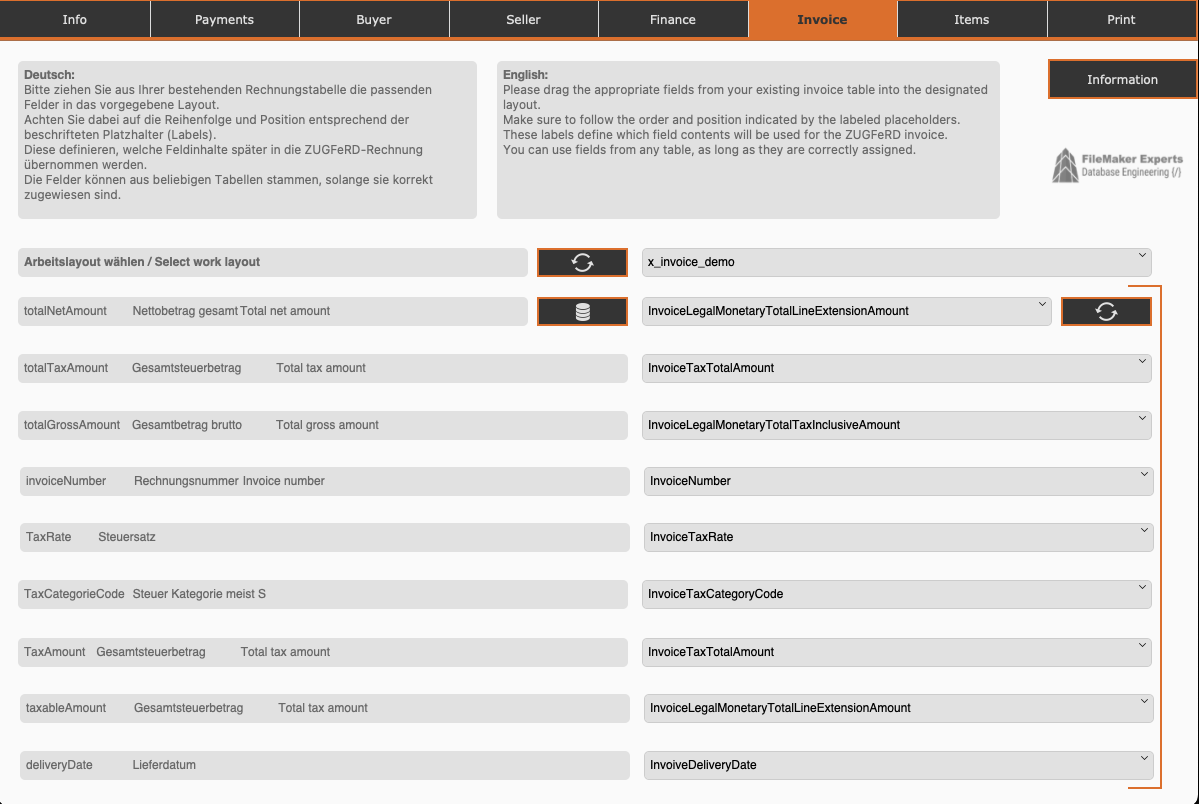

6. Invoice Tab - Invoice Amounts

AmountsMapping Invoice Amounts and Taxes

Select Work Layout: Dropdown: x_invoice_demo

| ZUGFeRD Field | Description | FileMaker Field |

|---|---|---|

| totalNetAmount | Total Net Amount | InvoiceLegalMonetaryTotalLineExtensionAmount |

| totalTaxAmount | Total Tax Amount | InvoiceTaxTotalAmount |

| totalGrossAmount | Total Gross Amount | InvoiceLegalMonetaryTotalTaxInclusiveAmount |

| invoiceNumber | Invoice Number | InvoiceNumber |

| TaxRate | Tax Rate | InvoiceTaxRate |

| TaxCategoryCode | Tax Category mostly S | InvoiceTaxCategoryCode |

| TaxAmount | Total Tax Amount | InvoiceTaxTotalAmount |

| taxableAmount | Total Tax Amount | InvoiceLegalMonetaryTotalLineExtensionAmount |

| deliveryDate | Delivery Date | InvoiveDeliveryDate |

Important Calculations:

- Net Amount = Sum of all line items (net)

- Tax Amount = Net Amount × Tax Rate

- Gross Amount = Net Amount + Tax Amount

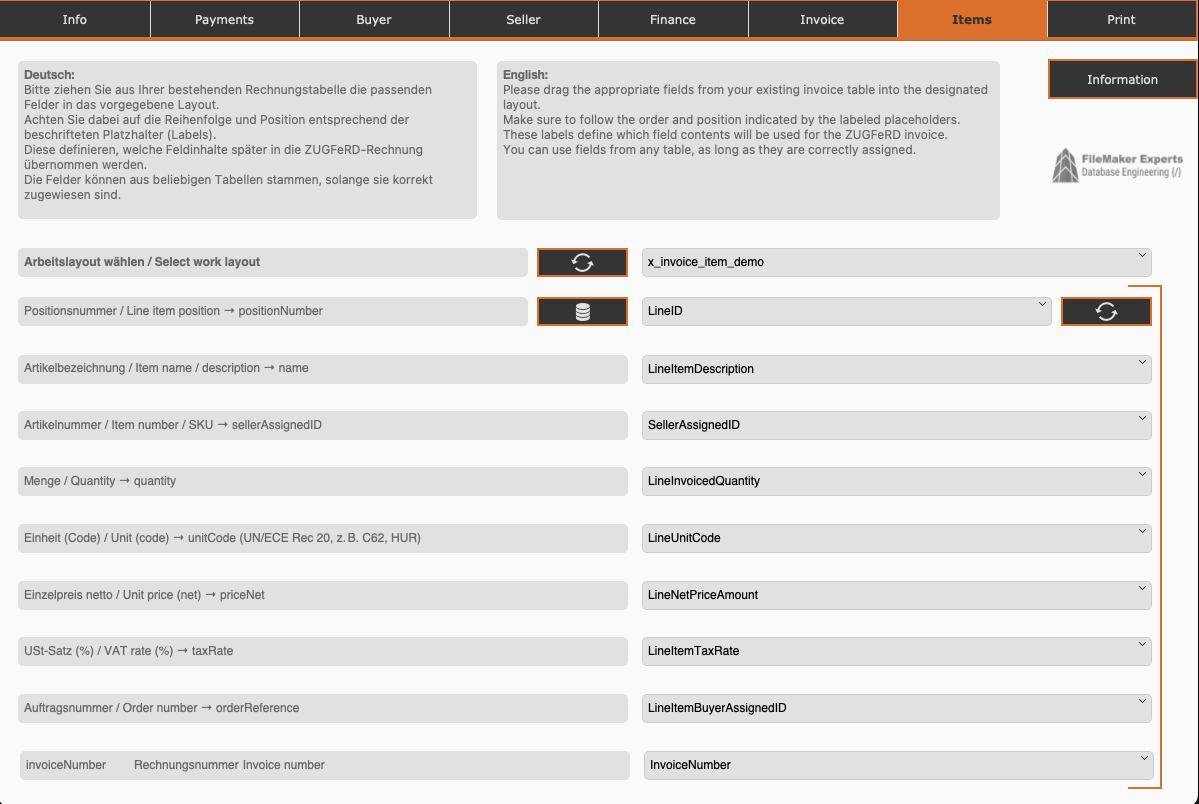

7. Items Tab - Line Items

Line ItemsMapping Individual Invoice Line Items

Select Work Layout: Dropdown: x_invoice_item_demo

| ZUGFeRD Field | Description | FileMaker Field |

|---|---|---|

| Position Number / Line item position | positionNumber | LineID |

| Item Description / Item name | name | LineItemDescription |

| Item Number / Item number | sellerAssignedID | SellerAssignedID |

| Quantity | quantity | LineInvoicedQuantity |

| Unit (Code) | unitCode (UN/ECE Rec 20) | LineUnitCode |

| Net Unit Price | priceNet | LineNetPriceAmount |

| VAT Rate (%) | taxRate | LineItemTaxRate |

| Order Reference | orderReference | LineItemBuyerAssignedID |

| invoiceNumber | Invoice Number | InvoiceNumber |

Important Unit Codes (UN/ECE Rec 20):

- C62 = Piece

- HUR = Hour

- DAY = Day

- MTR = Meter

- KGM = Kilogram

- LTR = Liter

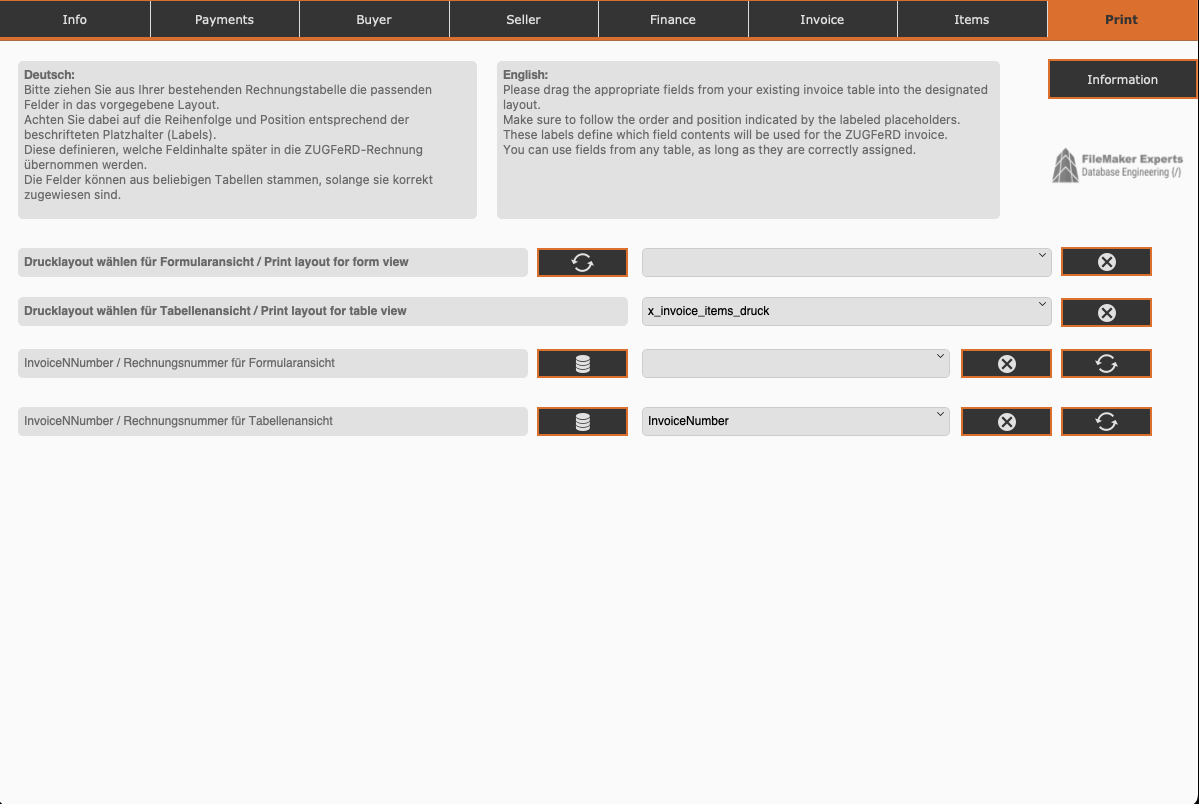

8. Print Tab - Print Layouts

PrintMapping Print Layouts for Form and Table View

| Setting | Description | Example |

|---|---|---|

| Select Print Layout for Form View | Layout for single view | (not set) |

| Select Print Layout for Table View | Layout for list view | x_invoice_items_druck |

| InvoiceNumber for Form View | Field Mapping | (not set) |

| InvoiceNumber for Table View | Field Mapping | InvoiceNumber |

Note:

- Form View: Single invoice with all details

- Table View: List of multiple invoice line items

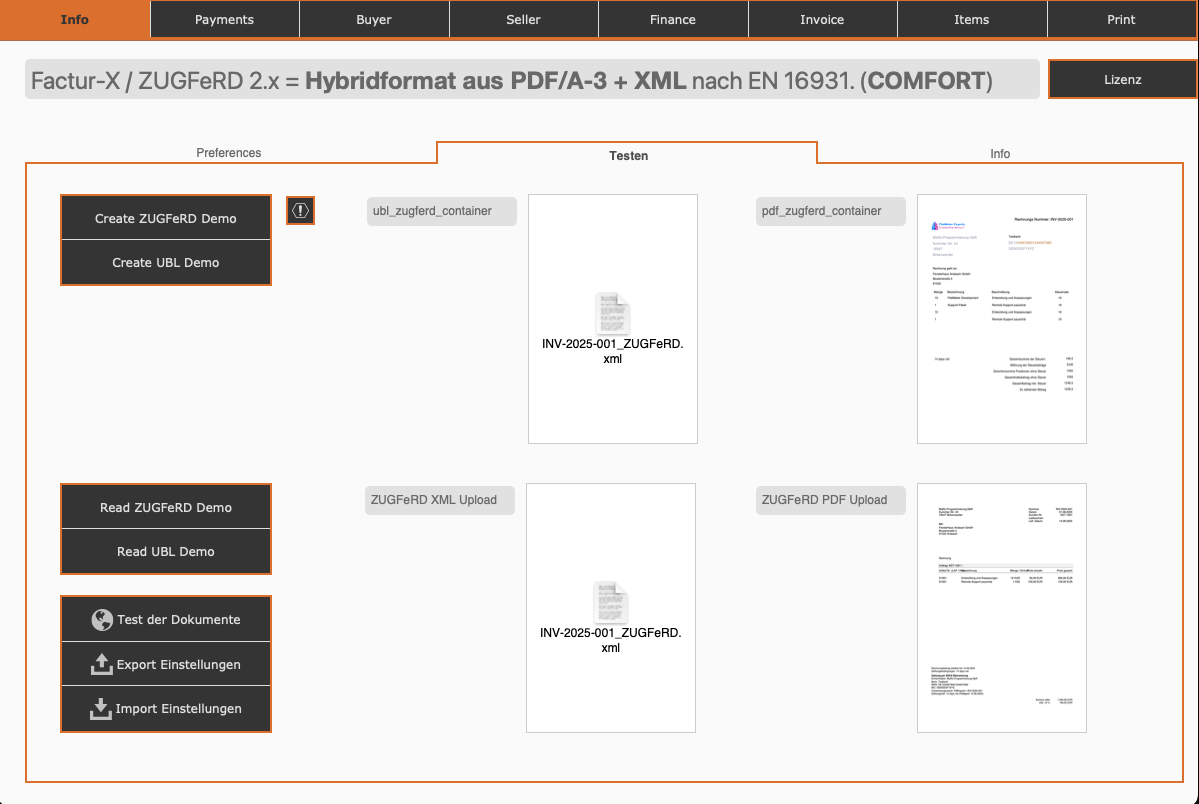

9. Testing Tab - Demo and Validation

TestCreating Demo Documents and Configuration Validation

Available Functions:

📝 Create Demo

- Create ZUGFeRD Demo - Creates a sample ZUGFeRD invoice

- Create UBL Demo - Creates a sample UBL file

📥 Read Demo

- Read ZUGFeRD Demo - Reads and validates a ZUGFeRD file

- Read UBL Demo - Reads and validates a UBL file

🔧 Additional Functions

- Test Documents - Validates the created documents

- Export Settings - Exports the current configuration

- Import Settings - Imports a saved configuration

Test Area

The middle area shows the containers:

- ubl_zugferd_container - XML file preview

- pdf_zugferd_container - PDF preview

Sample Files

- INV-2025-001_ZUGFeRD.xml - Generated XML file

- ZUGFeRD PDF Upload - Uploaded PDF with embedded XML

The test functions enable:

- Verification of the configuration

- Validation of generated documents

- Import/Export of settings for different environments

Best Practices

Field Mapping

- All mandatory fields according to EN 16931 must be mapped

- Use consistent naming for FileMaker fields

- Pay attention to data types (text, number, date)

Validation

- Regularly create test documents

- Check with official ZUGFeRD validators

- Test different invoice types (standard, credit note)

Maintenance

- Export and version configurations

- Maintain documentation of field mappings

- Verify mappings when FileMaker changes

Technical Notes

PHP Endpoints

The configured PHP scripts on the server maps.maro-test.de process:

- POST data from FileMaker

- PDF generation with embedded XML

- XML creation according to EN 16931

- File download via HTTP

Data Flow

- FileMaker sends invoice data to PHP endpoint

- PHP script generates ZUGFeRD-compliant PDF/A-3 file

- XML is created according to EN 16931 and embedded

- Finished file is made available for download

- FileMaker downloads file and stores it in container

🚀 Ready for ZUGFeRD in FileMaker?

Implement standards-compliant e-invoices with our proven add-on